Have you ever wondered if it’s possible to get rich off non-fungible tokens (NFTs)? With the rise of cryptocurrency, NFTs are becoming more and more popular. While there is no guarantee that investing in NFTs will make you wealthy, many people have found success with this relatively new form of investment.

In this article, we’ll explore what an NFT is, how they work, and whether or not they can help you become financially independent. We’ll also discuss the risks involved in investing in NFTs and some tips for getting started with them. So if you’re looking for a way to break free from traditional financial systems and build your own wealth, read on!

We all crave freedom – both physical and financial – but sometimes it seems impossible to achieve without taking huge risks. Investing in NFTs could be just the answer you’ve been searching for; however, it’s important to understand exactly how these digital assets work before diving into them head first. Read on to find out everything you need to know about making money from NFTs!

Definition Of NFTs

Non-fungible tokens, or NFTs, are digital assets that represent a tokenized form of ownership. Unlike traditional cryptocurrencies like Bitcoin and Ethereum which are fungible and interchangeable between users, NFTs are unique and non-interchangeable crypto-collectibles. They can be used to represent anything from physical objects such as real estate deeds to virtual items such as artwork or music recordings.

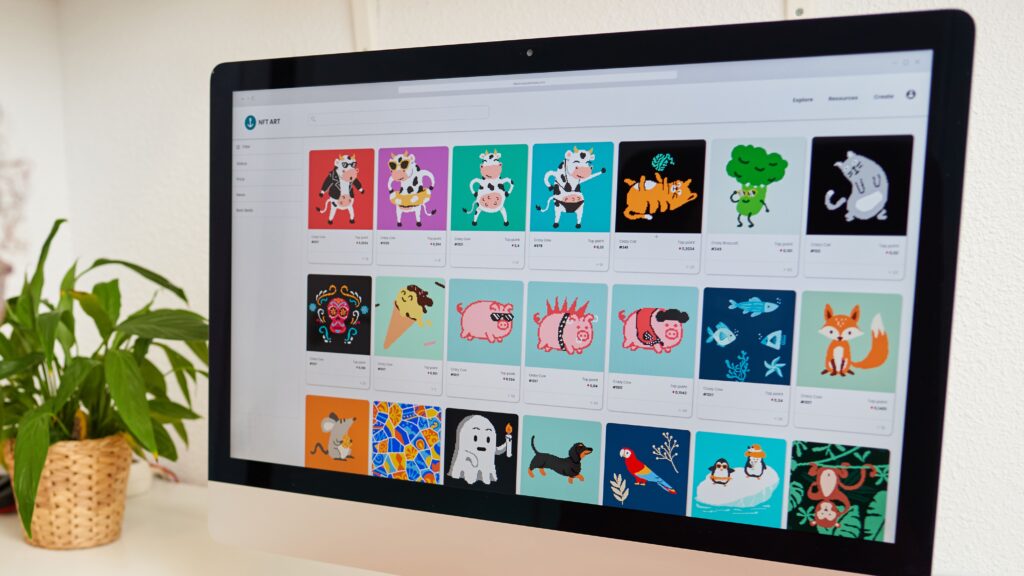

NFTs have opened up new possibilities for digital asset trading because they make the buying and selling process easier than ever before. With just a few clicks, anyone with access to the internet can purchase these rare digital collectibles on platforms such as OpenSea and Rarible. Furthermore, since each token represents a single item instead of a group of identical units (like coins), buyers can trade them individually without having to worry about double spending or other forms of fraud.

Moreover, due to their decentralized nature and blockchain technology backing them up, NFTs provide assurance that no two copies exist in circulation at any given time – making them perfect investments for those who want to own something truly special and secure its value over time. As cryptoasset markets continue to grow, so too will the demand for these innovative tokens; now may very well be the best time to get involved in this burgeoning industry!

Advantages Of Collecting NFTs

NFTs have emerged as a powerful tool for collectors looking to gain ownership rights of rare digital art. In this regard, they offer various advantages over traditional collecting methods.

The first advantage is that NFTs are secured and tracked via blockchain technology. This makes it nearly impossible for anyone to make unauthorized copies or duplicate the asset without permission. It also allows you to track who owns your asset, when it was bought or sold, and other important information about its history.

Second, investing in NFTs can potentially lead to substantial returns due to their rarity and potential demand from other collectors. As such, if you’re able to acquire an especially sought-after piece of digital artwork early on, you could find yourself earning quite a bit of money down the line should its value increase over time.

Finally, NFT collecting offers unique opportunities for engagement with other like-minded individuals around the world who share similar interests in rare digital art assets. For example, many popular platforms allow users to create communities centered around specific works of art wherein members can discuss pricing trends and collaborate on projects related to the work itself—all while having direct access to the original artist if applicable!

What To Consider Before Getting Into NFTs

Investing in NFTs is like diving into the deep end of a pool. You can get rich, or you could find yourself treading water with no lifeguard in sight. Before jumping into the water, it pays to make sure you understand the risks and rewards associated with owning digital assets.

The first thing to consider when investing in NFTs is your strategy. Do you want to buy low and sell high? Are you looking for long-term growth opportunities? Knowing what type of investor you are will help guide your decisions. Additionally, it’s important to be aware of any crypto taxation laws that may apply to your investments.

When considering an investment in NFTs, security should also be top-of-mind. Make sure that any platforms where you store or trade your digital assets have strong security protocols in place. Also, research any potential scams related to NFT investing and learn how to spot fraudulent activity before getting involved.

NFTs offer exciting possibilities for investors who know how best to navigate them – but they come with risks as well. It’s up to prospective investors to do their homework and decide if these digital assets fit their portfolio goals and risk tolerance level before taking the plunge.

Types Of NFTs Available

NFTs, or Non-Fungible Tokens, offer a unique way to get rich. They come in many shapes and sizes, ranging from cryptoart to digital collectibles, gaming assets and virtual land, music tokens and more. Let’s take a look at some of the different types of NFTs available:

- Cryptoart: This type of NFT allows people who appreciate art to buy pieces that can be displayed on their wall – but instead of physical artwork, they are buying digital versions with the power of blockchain technology behind them.

- Digital Collectibles: These are often used for trading cards and other items like figures or toys. The difference between these collectors’ items and normal ones is that there is only one version ever created – what you purchase is truly unique!

- Gaming Assets: In games like Decentraland and Cryptovoxels, players can purchase virtual land as an asset which increases in value over time as the game grows in popularity. It also provides users with exclusive access to certain areas within the game world which could potentially be very lucrative if successful enough.

- Music Tokens: Musicians have been using this type of tokenization to reward fans for supporting their work by giving them special access to exclusive content or merchandise through smart contracts embedded into each track purchased via blockchain technology.

NFTs provide a great opportunity to generate wealth – whether it’s through owning valuable digital property or simply collecting rare items that will increase in value over time due to scarcity alone. With so many options out there now, investors should spend some time researching before jumping into any specific project so they know exactly what they’re getting into and how much potential return on investment (ROI) it may hold long term.

Marketplaces For Buying And Selling NFTs

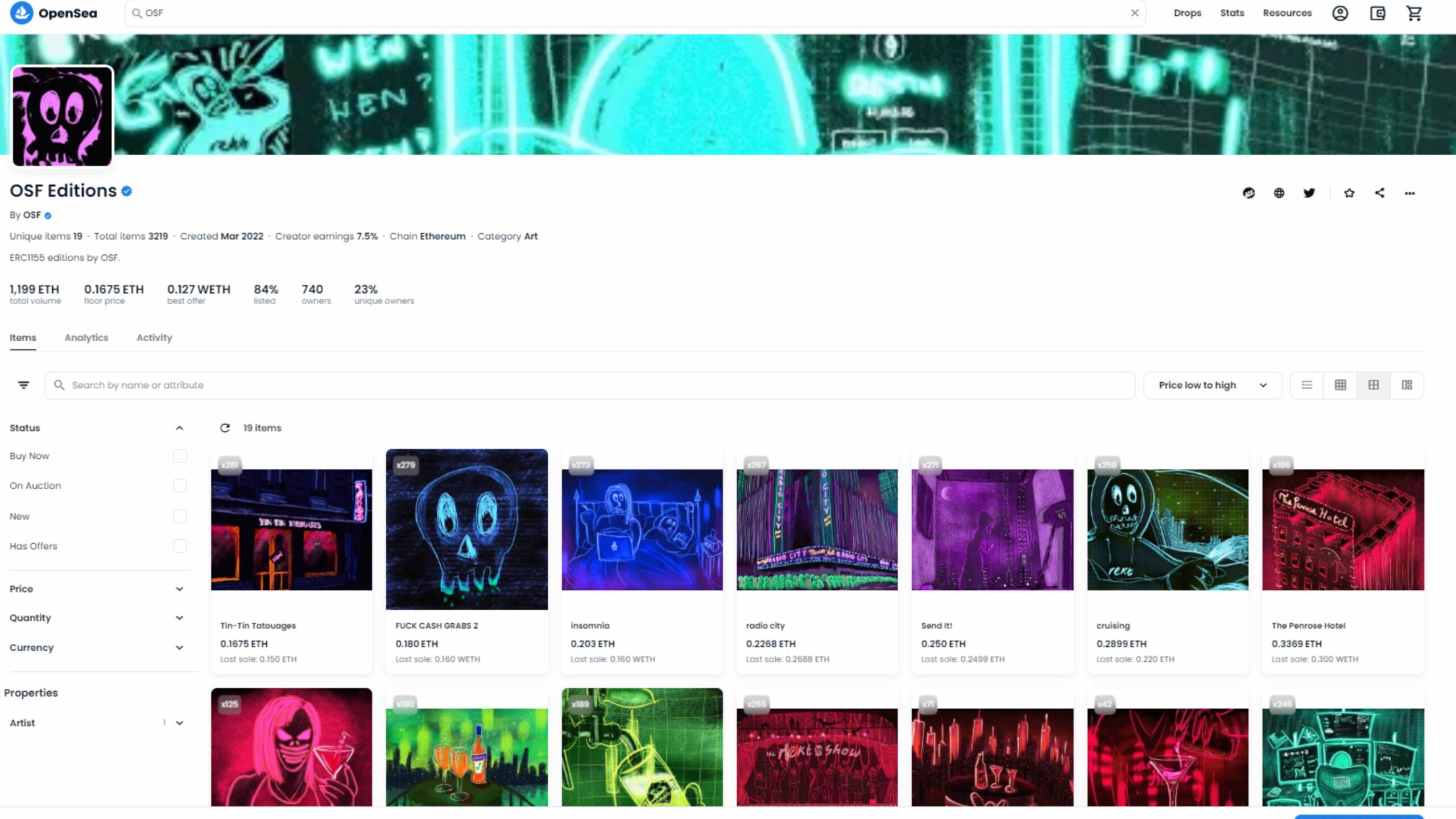

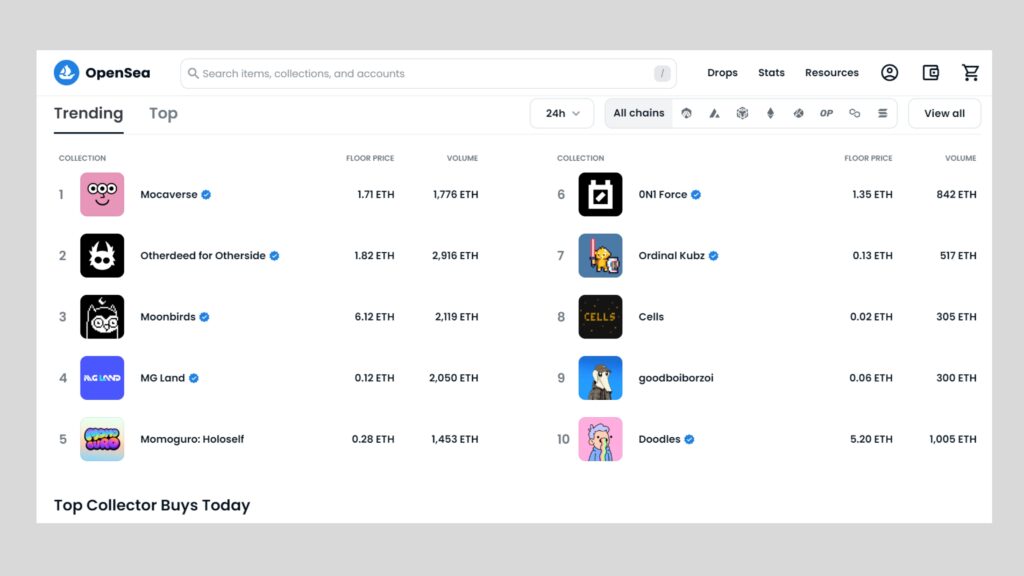

Now that we understand the different types of NFTs available, it is time to explore the marketplaces for buying and selling these digital collectibles. In order to become a successful trader in this space, one must be aware of the various platforms available and how they can help you make your dreams of financial freedom come true.

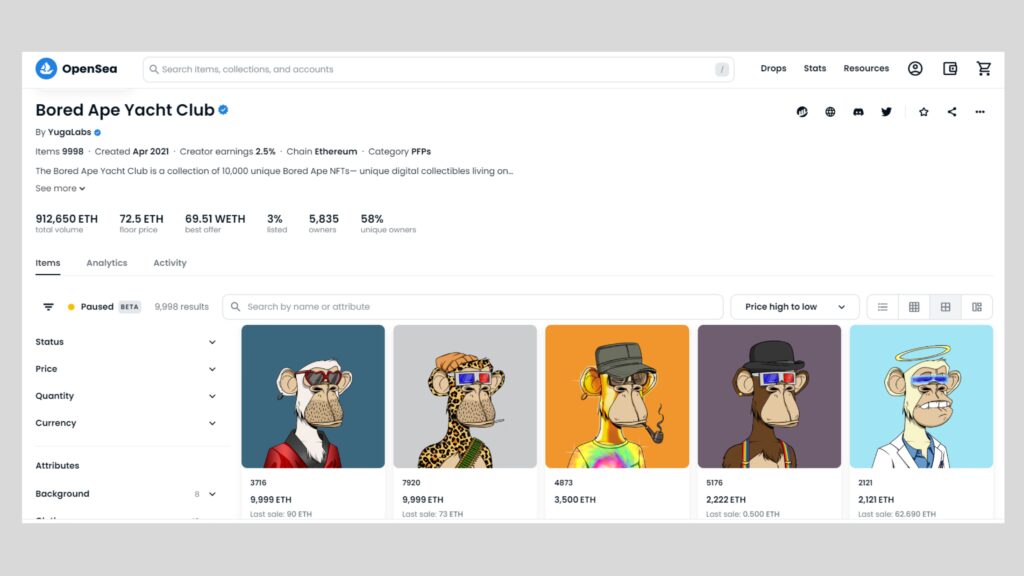

The first step is finding an appropriate platform to buy or sell your desired NFTs. There are several options out there with their own unique features such as OpenSea and Rarible. These websites offer users the ability to purchase, trade or auction off their digital assets quickly and safely while providing them with real-time pricing information so that they know what other traders are paying for similar items.

In addition, many of these sites also have communities where experienced traders can give advice on trading strategies and share valuable tips about potential deals or investments. This allows newcomers to learn from more experienced players and grow their portfolio without having to take any unnecessary risks. Furthermore, some platforms even allow new investors to get started with low stakes by offering virtual currency which has no value outside of its marketplace – something very useful when testing out different strategies before investing real money into NFTs.

It’s clear that if you want to unlock the potential riches offered by investing in NFTs then understanding how these markets work is essential. By researching each platform carefully and taking advantage of all the resources they provide, you will be well on your way towards becoming a profitable trader who can enjoy financial freedom whenever they please!

Researching The Value Of An NFT

It’s no secret that Non-Fungible Tokens (NFTs) have been making waves in the cryptocurrency sphere. According to a recent report, NFT sales have surpassed $150 million this year alone — an increase of nearly 700% from 2020! But can you really get rich off these digital tokens?

The answer depends on your definition of “rich” and how much research into their value you do beforehand. To find out what your particular NFT is worth, there are several methods you can use:

- NFT Appraisal: Many experts offer appraisal services to help determine the market value of an NFT. This involves researching similar assets and assessing the quality of the artwork or content associated with it.

- Pricing History: By looking at past sales prices for similar NFTs, investors can gain insight into potential future values. It’s important to note that historical data isn’t a guarantee of future performance, however.

- Valuation Models: Expert analysts may also use complex financial models to evaluate an NFT’s worth based on its underlying asset and other factors such as supply and demand dynamics.

Ultimately, understanding an NFT’s true value requires doing some homework first—but if done correctly, it could be well worth the effort. With careful research into pricing history, valuation models, and professional appraisals, investors can make informed decisions about whether they want to invest in specific NFTs and potentially reap huge rewards down the line.

Determining The Value Of An NFT

When it comes to determining the value of an NFT, there is no one-size-fits-all answer. While many factors can influence the worth and pricing of an NFT, ultimately it’s up to the market – or more specifically, individual buyers – to decide what an NFT is actually worth. Fortunately, there are a few ways you can evaluate and appraise your own NFT prior to selling it in order to get an idea of its potential worth.

First off, look at the profile of other similar pieces that have sold on various platforms. This will give you a good indication as to how much people are willing to pay for similar works. You should also consider any additional features that make your piece stand out from others like it; this could include things such as exclusivity, rarity or even just its aesthetics. All these elements can affect how much someone might be willing to pay for your particular work.

Finally, keep track of industry news and trends related to crypto art and digital collectibles so that you know when best to put your NFT out for sale and adjust your asking price accordingly if need be. By doing some research ahead of time, you’ll be better equipped with knowledge about how much people are currently paying for artwork like yours which will help inform decisions around nft evaluation and appraisal before putting it up for sale.

Strategies For Increasing The Value Of An NFT

There are several strategies for increasing the value of an NFT. Investing in the right digital asset is key, so it’s important to do your research and stay informed on current market trends. This means analyzing recent sales data, studying various digital assets, and understanding how different factors can affect their appreciation over time.

Researching historical performance is also beneficial; this will help you understand which types of digital assets have appreciated or depreciated significantly and why. Similarly, tracking events such as new releases or partnerships related to specific digital assets may provide insight into whether they could become more valuable in the future. Additionally, determining what type of platform or marketplace the NFT resides on is important; some platforms offer better liquidity than others.

Ultimately, investing in any type of asset requires a certain amount of risk-taking – but with careful planning, analysis, and research you can increase the chances that your investment will appreciate in value over time. By keeping up with news and developments within the blockchain industry and staying abreast of changes to regulations surrounding digital asset investments, you can get ahead when it comes to predicting potential gains from an NFT purchase.

Risks Associated With Collecting NFTs

NFTs are a relatively new phenomenon, and with any new technology comes the risk of fraud. Despite their advantages, non-fungible tokens have some unique risks that collectors should be aware of before investing in them. NFT scams, security issues, fraud, theft, and hacking can all impact your collection if you’re not careful.

When it comes to scams, there is always the chance that someone could try to sell you fake or counterfeit NFTs. There are also certain individuals who may try to artificially inflate the value of an NFT by creating hype around it on social media platforms. It’s essential that investors research every purchase they make carefully so as not to get duped out of their money.

Security concerns are another major issue when it comes to collecting NFTs. Since these assets exist on blockchains like Ethereum, they’re vulnerable to hackers looking to steal funds or personal information from users’ wallets. Collectors must ensure that their wallet provider has strong encryption methods in place and never share private keys online—even with trusted friends and family members. Additionally, many digital asset exchanges require users to verify their identities before trading which adds another layer of protection against fraudsters.

Collecting non-fungible tokens isn’t without its risks; however, understanding what those risks entail can help minimize potential losses down the line. As long as buyers do their due diligence and understand the possible pitfalls associated with owning this type of asset class then they should be able to enjoy all the benefits offered by NFTs without having too much cause for concern.

Tax Implications For Investing In NFTs

Following the risks associated with collecting NFTs, one must also consider the tax implications of investing in these digital assets. Investing in a non-fungible token (NFT) involves more than just being an avid collector; it can be complex and require careful adherence to certain rules and regulations. Here are some important points to keep in mind when considering the tax implications for investing in NFTs:

- Understand your local laws regarding taxes on cryptocurrencies, such as capital gains taxes or sales taxes.

- Become familiar with the federal guidelines for reporting income from cryptocurrency transactions.

- Make sure you understand all applicable nft tax rates that may apply to your investment activity.

Having a thorough understanding of these key components is essential if you want to get rich off of NFTs without running into any legal issues later down the line. It’s also wise to consult a qualified financial advisor who specializes in taxation before making any major investments into cryptoassets like NFTs. They should be able to provide guidance on how best to navigate any potential pitfalls related to nft capital gains taxes and other relevant topics so you don’t end up losing money due to improper filing procedures or misunderstandings about nft tax rules.

Investing wisely in NFTs has the potential for great returns over time, but only if done correctly within the boundaries set by law. By researching nft tax implications thoroughly beforehand and consulting a professional whenever needed, investors can ensure their success while still maintaining their desire for freedom!

Legal Issues Related To Owning An NFT

Owning an NFT can be a lucrative investment, but there are legal issues to consider before buying one. It’s important to be aware of the intellectual property rights associated with your purchase and any contracts you may enter into related to it.

In order for someone to own an NFT legally, they must have a copyright in place or obtain permission from the artist who created the work that was tokenized. This ensures that no other person has ownership of their work without their consent. Additionally, it is important for buyers to understand what rights come with owning an NFT – such as the right to resell or license the artwork – so that those rights are not infringed upon by another party.

When purchasing an NFT, buyers should also make sure they fully read and understand all of the terms outlined in the smart contract. Smart contracts define how the asset will be transferred between parties and set out rules around how payments are made and when funds become available after payment has been completed. They also contain provisions about dispute resolution and ensure both buyer and seller know their respective obligations under law if something goes wrong during the transaction process. Understanding these details is key to ensuring a safe and successful purchase experience.

It’s essential for anyone considering investing in an NFT to take time to do research on its legality prior to making any purchases. Knowing your rights as a buyer, understanding intellectual property laws, and reading through smart contracts carefully can help protect you from any potential legal issues down the road.

How To Store Your Owned NFTs

Storing your NFTs is essential if you want to get rich off them. It’s important to keep your digital assets safe and sound, while also making sure they are easily accessible when needed. There are a few different ways to store your owned NFTs securely, such as using a digital wallet or blockchain storage solutions.

Digital wallets, often referred to as “hot wallets”, provide an easy way for users to access their crypto holdings in one place. They offer the convenience of being able to send and receive tokens with ease, plus many come with enhanced security features like two-factor authentication (2FA) and multi-signature confirmation processes. Cold storage methods can be used alongside hot wallets for added security – these involve storing cryptocurrencies offline on external hard drives or USB sticks which aren’t connected to the internet. This makes it impossible for hackers to access the assets stored there.

For those looking for extra peace of mind when it comes to NFT storage, there are various blockchain solutions available that enable secure storage options and give users full control over their assets. These include hardware (e.g., Ledger), software (e.g., MetaMask) and cloud services (e.g., Coinbase). With any of these solutions, users can easily transfer ownership rights from one person/entity to another without having to worry about potential hacks or malicious activity taking place within the network itself. Ultimately, choosing the right method will depend on how much money you’re willing to invest in order protect your investments – but no matter what option you choose, make sure you always practice good cybersecurity habits along the way!

Tips For Creating Your Own Unique Digital Assets As An NFT

Creating your own unique digital assets as an NFT can be a great way to make money. With the right knowledge and skills, you could potentially become quite wealthy by creating and selling your own digital artwork or other collectibles on blockchain platforms like Ethereum. But before you get started, it’s important to understand what is involved in creating your own NFTs and how to store them securely.

When creating an NFT, it’s essential to have some basic technical know-how about coding and programming for the respective platform (e.g., Ethereum). To create a fully valid NFT, you’ll need access to developer tools such as Solidity or web3 libraries that will allow you to code the contract associated with each asset. You also need to consider factors such as storage capacity because if the file size of your asset exceeds available memory then users won’t be able to use it properly after purchase.

Finally, once you’ve created your NFTs, you should ensure they are stored securely so that no one else can tamper with them or steal them from their rightful owner(s). There are numerous methods for storing NFTs depending on their type; some blockchain networks offer their own wallets while others require third-party services like MetaMask or Coinbase Wallet – both of which provide secure storage options but come at a cost. It’s therefore important that you do your research and take all necessary precautions when attempting to monetise your digital assets creation efforts through NFTs

Examples Of Successful Collectors In The Market

It’s no surprise that the NFT market is becoming increasingly popular. In 2021, the total value of all minted NFTs exceeded $2 billion USD- and shows no signs of slowing down anytime soon! With such a booming industry, it’s only natural to wonder if you can make money off Non Fungible Tokens (NFT).

Here are some examples of successful collectors in the market:

- Mike Winkelmann – better known as Beeple – earned over $3.5 million from his digital art sales on Christie’s auction house.

- An anonymous bidder paid nearly 70 ETH for Mark Cuban’s NBA Top Shots trading card collection.

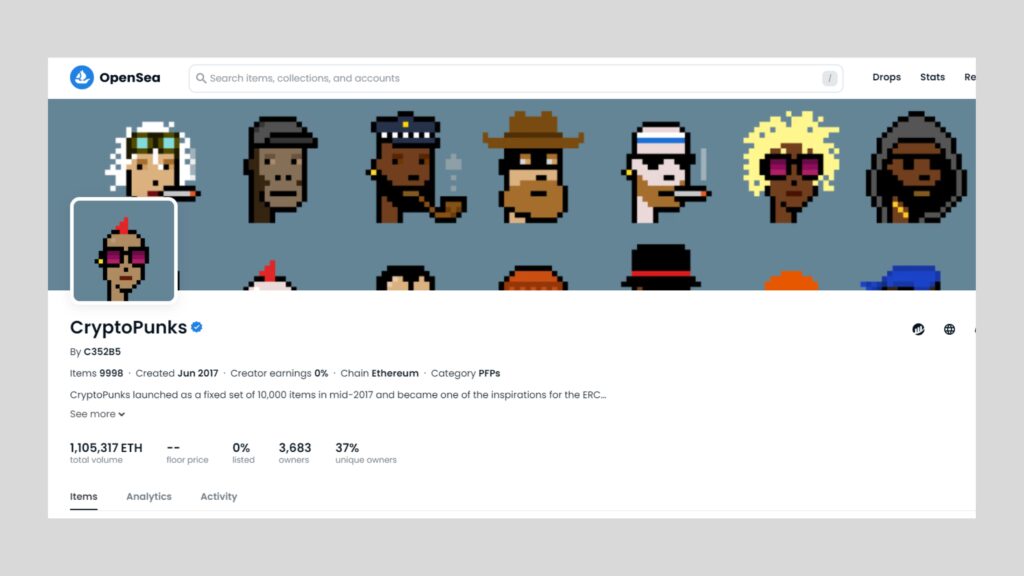

- A CryptoPunk crypto-collectible was sold at an auction in May 2020 for 600 ETH ($765,000).

- Finally, one collector purchased Jack Dorsey’s first tweet for 2.9 million dollars!

These success stories prove that with enough dedication and knowledge about the market, anyone can become a successful NFT investor or collector. If you’re looking to get into this exciting space, there are plenty of resources online to help guide your journey. You should also consider joining community forums where experienced traders discuss their successes and failures – so you can learn from them too! Investing in NFTs could be a great way to diversify your portfolio and potentially turn a profit while having fun collecting unique pieces of digital art or other sought after collectibles. So why not take advantage of this new opportunity?

Advice From Experienced Collectors

Moving on from successful collectors in the market, let’s take a look at some advice from experienced collectors. Investing in digital assets has become increasingly popular and lucrative over recent years. With that said, it is important to understand the risks associated with investing in NFTs before you get started. Experienced crypto art collectors have shared their valuable insights about how to maximize returns when investing in the NFT marketplaces and what strategies work best for them.

One of the most common pieces of advice from seasoned collectors is to diversify your portfolio by investing across multiple NFT markets. This will help reduce risk as well as provide more opportunities for profits. Additionally, many recommend doing extensive research into which projects are likely to be profitable in the future and keeping track of trends within the industry. Keeping up-to-date with new developments such as emerging technology or upcoming auctions can also give an investor a leg up on finding potential investments worth considering.

In addition to researching individual projects, experienced investors suggest staying informed about broader movements within the crypto art space like notable sales or major partnerships between companies. All these elements contribute to forming educated decisions when looking into investments that may yield higher returns than others. Ultimately, understanding both short term and long term goals while being honest with yourself about any limitations when it comes to budgeting is key for success when collecting digital assets through NFTs.

Conclusion

Collecting NFTs has the potential to be a lucrative venture, depending on how savvy an investor you are. It’s like playing the stock market; if you know what you’re looking for and which digital assets will fetch a high price, there’s always a potential that someone gets rich off of it. But collecting NFTs carries a whole multitude of risks as well, and a good rule it to assume that any investment into this will got to zero as the default scenario!

Before getting into NFTs, do your research and make sure that you understand both the advantages and disadvantages associated with them. Make sure that you take into account all factors before investing in any type of asset, whether physical or virtual. Consider things such as liquidity, supply/demand forces and what kind of return on investment would be reasonable for your chosen asset class.

Overall, NFTs are an exciting area to explore but they should not be taken lightly – think carefully about any purchase and learn from others who have ventured this way before you. Collecting NFTs is like navigating uncharted waters – so choose wisely!

Disclaimer:

This article should not in any way be seen as investment advice. Please do your own research before even thinking about putting any hard-earned money into NFTs or cryptocurrencies!

Author: Robin Olsson

Author Bio: I’m Robin and on this website, I share everything I’ve learned since getting into NFTs in 2021. I have a background in research and I’ve been in crypto for several years. You can read more about me here.